Lauren Young • November 1, 2021Perspectives

Three ways to prepare for your IPO

How to get your financial cadence, corporate governance and narrative ready for the scrutiny of the public markets

- Readying a company for the public markets demands a sustained focus not only from the finance department, but also from the CEO and management team

- Regular and frequent reviews of interim results, metrics and market conditions are essential to develop the operational and financial excellence investors expect

- At the root of every successful IPO is a clear and bullet-proof story about what makes a company unique, what problems it solves and why its financial model is robust

CEOs often refer to an IPO as just one step along the road to building a lasting company. That’s true, but it’s also a step unlike any other—one that requires thoughtful and methodical planning.

Some companies reach that milestone quickly; others after years of gradually scaling operations and gaining traction with customers. Regardless, things really change once they ring the opening bell.

The startup mindset focuses on cranking out products, finding scale and raising money. Public companies have a different focus and face a much larger audience. Public-market investors put a premium on a clear and compelling story, significant visibility into long-term growth and a solid corporate foundation. They expect news of “unexpected” upside to land with a regular cadence.

None of that happens overnight—even at a successful, well-run private company. The process of preparing for life in the public markets is a multifaceted endeavor that requires a sustained focus from CEOs and management teams. The ultimate goal is to give the company the robust governance structure, clear narrative and operational and financial excellence that public-market investors demand.

Here are a few critical elements of that process that companies should pay special attention to:

Establish a financial cadence

By the time you’ve decided to take your company public, you should already be well versed in reporting results and delivering financial projections to venture and other investors. But public-market investors will place a whole new set of demands on your company that will require you to up your financial game. You’ll need to decide on a few key metrics that you plan to disclose and devise your compensation in ways that incentivize your team to deliver on them.

Quarter after quarter, you’ll have to give out forecasts; aim to top them—preferably by a hair, not a mile—and raise expectations for future results.

In particular, you’ll have to perfect the game of “beat and raise” that investors have come to expect. Quarter after quarter, you’ll have to give out forecasts; aim to top them—preferably by a hair, not a mile—and raise expectations for future results.

There’s a certain science to it. It starts with a strong CFO and a great financial, planning and analysis team. No matter how good they are, you’ll need a few quarters of practice while you’re still private. It will require discipline and upping the cadence at which you review interim results and market conditions. Don’t underestimate how hard this will be, as you mix hard-nosed analysis with your instincts about your business’s momentum, to come up with the right formulas for predicting results—and outperforming them time and again.

As you grow your board, insist on diversity

Chances are, your private company’s board is made up in large part of a tight network of investors, often with overlapping relationships, who are eager to cheer you on.

When you go public, some of those board members will leave. As you think about replacing them, and likely expanding your board, you must remember that a public board serves a different function. The bar for accountability rises significantly, and luring independent voices that can bring new skills and challenge groupthink is essential. You’ll need independent directors to chair your audit and compensation committees. And you’ll want a roster of expert leaders who can help drive your business—customers, CEOs of complementary businesses and executives who have scaled companies of similar size before.

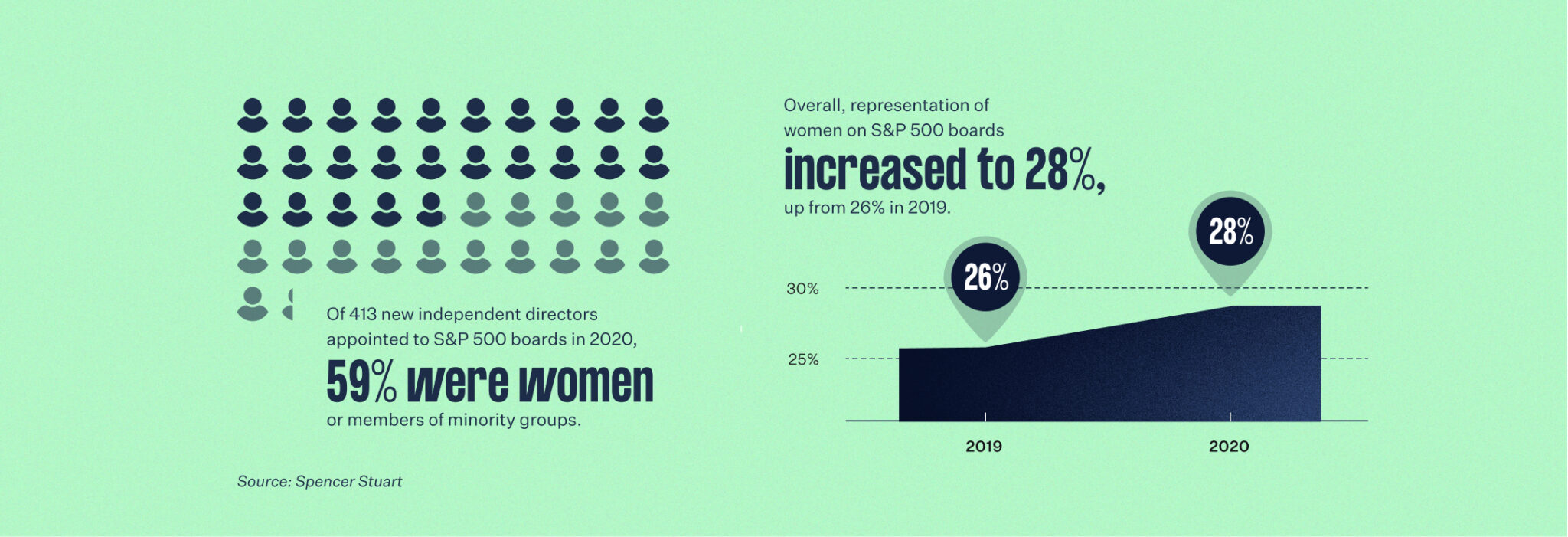

As you assemble your new board, don’t forget that diversity and inclusion are more critical to board composition than ever before. Companies are under pressure to diversify, and not only because it’s the right thing to do amid societal shifts. In recent years, study after study has shown that diversity and performance are intimately linked. Companies seem to be getting the message. Of the 413 independent directors appointed to the boards of S&P 500 companies in 2020, 59% were either women or members of a minority group, according to a study by the executive search firm Spencer Stuart. As a result, now every one of those companies has at least one female director for the first time since the firm started tracking board diversity in 1998.

Market participants are also increasingly insisting on diversity. Goldman Sachs, for one, will not help a company IPO if it doesn’t have at least one woman or minority on its board. BlackRock has said it will vote against companies without at least one female board member, and California has gone so far as to require companies headquartered there to have at least one female board member, depending on the size of the company. At Advent, we track board diversity, and our limited partners hold us accountable on this metric.

Sharpen your narrative

Since day one, you’ve known what makes your company tick, and you’ve been good at telling that story to your private investors. As you face the public markets, however, many more people are going to try to poke holes in it.

Confronting that successfully requires a new level of understanding and refinement of your narrative. In short, your story needs to be simple and bullet-proof, clearly explaining what you do, what’s unique about your company, why your product is sticky or entrenched, what problems you solve, why you can fend off today’s rivals and those who will come after you tomorrow, and why all that translates into a powerful financial model.

The path to getting that story right starts with making sure your bankers understand it and believe it. Then you’ll want to socialize it more broadly with increasingly large groups of potential investors. As you do, listen for questions and feedback, as they will help you identify weak spots in your narrative and areas where you need to push back. When necessary, enlist your customers, who can help make the case for why your product solved their problems. This is especially important in technology, where your core value proposition can be hard for nontechnical people to understand.

Takeaway

Ultimately, getting ready to go public is an all-encompassing endeavor. Perhaps the most challenging part of it is just overcoming the muscle memory of running a startup. In everything from operations, to finance, governance and even your basic story, what worked yesterday may no longer be what’s right for tomorrow.